Artificial Intelligence is not just another technology trend: in many ways, it feels like a land grab. Everyone, from tiny startups to multinational giants, from governments to universities, is racing to stake a claim in who owns the future of AI. But “ownership” in Artificial Intelligence is multi-dimensional: owning the models, owning the data, owning the infrastructure, owning the regulations, owning the ethical frameworks. This article digs into how that gold rush is unfolding, who the major claimants are, what they want, the risks, and ultimately, who may end up owning “AI.”

What does “owning Artificial Intelligence” mean?

Before naming names, we need to define what it might mean to own AI. Several overlapping domains of ownership are:

- Model ownership – controlling foundation models, LLMs (large language models), vision models, etc.

- Data ownership – access to and control over large, high-quality, proprietary datasets; who labels, who curates, who owns user data.

- Compute/infrastructure ownership – chips, GPUs, TPUs, AI accelerators; data centers; cloud infrastructure; edge computing.

- Regulatory and legal ownership – who sets the rules, standards, liability frameworks, and IP regimes for AI.

- Intellectual property, algorithmic & software ownership – the software frameworks, algorithms, licensing, open source vs closed source.

- Application/domain ownership – owning verticals where AI is deployed: health, finance, autonomous vehicles, etc.

Each layer is a lever: if you own the infrastructure, you get cost advantages; if you own the data, you can train better models; if you own the regulation, you shape what is possible. The gold rush is really about capturing control in as many of these layers as possible.

Who are the major players staking their claim?

Here are the key contenders across different layers, some already deeply embedded, others up-and-coming.

Big Tech Giants

- NVIDIA: A leader (arguably the leading one) in compute/infrastructure. Their GPUs are the backbone of training large AI models; their CUDA software stack is deeply entrenched. Controlling the hardware gives NVIDIA enormous influence.

- Microsoft: Through its massive investment in OpenAI, its Azure cloud platform, and embedding AI in its suite of productivity tools (Microsoft 365, GitHub Copilot, etc.), Microsoft is aiming for both model ownership and application/domain ownership.

- Google / Alphabet: Deep in all layers. Google has its own models, its infrastructure (e.g. TPUs), massive data, strong AI R&D via DeepMind, etc., plus control over search/advertising, which gives it both reach and economic leverage.

- Amazon (AWS): Key player in cloud provision, infrastructure, and increasingly in providing AI services via cloud, enabling companies to build/run AI without owning all the hardware themselves. While perhaps less visible in foundational model development, AWS is central to provisioning.

- Meta, Apple, IBM, etc.: Meta has been pushing in model research (LLMs, large-scale social media data), Apple is focusing on device-level AI, privacy, edge, etc. IBM leverages enterprise domain and legacy computing, plus AI services. Each has different strengths in specific layers.

Emerging Players, Startups & Regionals

- OpenAI: Perhaps the poster child of model ownership, pushing state-of-the-art LLMs. It’s also in an interesting hybrid structure (for-profit subsidiary under a non-profit umbrella), which gives it some unique leverage and constraints.

- Chinese players: Companies like Baidu (with its AI stack, search dominance, and autonomous vehicle efforts) and newer firms (e.g., Moonshot AI) are also serious claimants in both data and model ownership.

- Specialized startups: Companies focused on specific verticals (healthcare, finance, biotech) or services like data labeling, fine-tuning foundation models, model evaluation, or edge-AI are also essential parts of the ecosystem. Perhaps they won’t “own” the broad foundation models, but they may come to own specific application domains and complementary services.

- Governments and regulators: This is less about profit, more about control, safety, ethics, and geopolitical positioning. States that build sovereign AI infrastructure, regulate data and model use, impose export controls, etc., will play a crucial role in who gets to own what in AI.

Key battlegrounds & dynamics

Knowing the players, let’s see what the battlegrounds are, where the competition is fiercest, and what trade-offs are involved.

1. Compute & hardware

Compute is often described as the physical foundation of AI power. Anyone can talk about clever algorithms, but training massive models requires enormous GPU/accelerator capacity, power, cooling, and data center infrastructure. Whoever controls this wins many battles.

- The barrier to entry is very high due to cost and specialized engineering. That gives incumbents like NVIDIA, Google, AWS, and Microsoft a strong advantage.

- But pressure is growing for alternatives: more efficient architectures, custom AI chips, geographic diversity of data centers (for latency, regulation, sovereignty). Some startups are trying to build software layers that allow AI to run across different hardware vendors. For example, Modular is trying to reduce hardware lock-in by enabling AI workloads across chips without code rewrites.

2. Data and model access

- Data is the fuel. Foundation models trained on massive datasets tend to be dominated by those with vast troves of data (search engines, social media, user-generated content, etc.).

- But there are concerns: bias, privacy, ownership, consent. Owning data is not just collecting it, but being able to use it ethically and legally.

- Open vs closed models: Open source foundation models versus closed proprietary ones. Open source gives more access and democratization; closed models may give more control and profit. The tug between openness and commercial/ethical risk is an ongoing tension.

3. Intellectual property, licensing, and regulations

- Who owns the IP (algorithms, weights, model architectures)? Licensing (open source vs commercial) shapes who can build on what.

- Regulatory frameworks (national and international) will influence allowed uses, data privacy, model audits, and liability for harm. Regions with stronger regulation (EU, etc.) could become centers that force global actors to comply, similar to the “Brussels Effect.”

- Export controls (e.g., for chips), cross-border data flows, and security concerns, all can fragment markets and shape who can “own” in which locales.

4. Vertical domination vs horizontal platforms

- There’s a difference between owning base infrastructure/model versus owning specific vertical use cases (healthcare, law, finance, autonomous vehicles). Some companies will focus on dominating verticals (e.g. startups providing AI-enabled diagnostics or legal AI tools).

- Horizontal platforms (cloud-providers, foundation model providers) seek large scale, but verticals may offer higher margins, defensibility, and domain expertise.

5. Ethics, public trust, and social license

- Because AI can misbehave, cause harm, replicate bias, infringe privacy, or be used for misinformation, who “owns” AI also depends on public perception and ethical norms.

- If a firm is seen to violate privacy or safety, regulatory and public backlash can curtail its freedom. Social license (trust) is, therefore, itself a kind of ownership, control over perceptions, norms, and legitimacy.

Who is likely to win, and what combinations of ownership might emerge

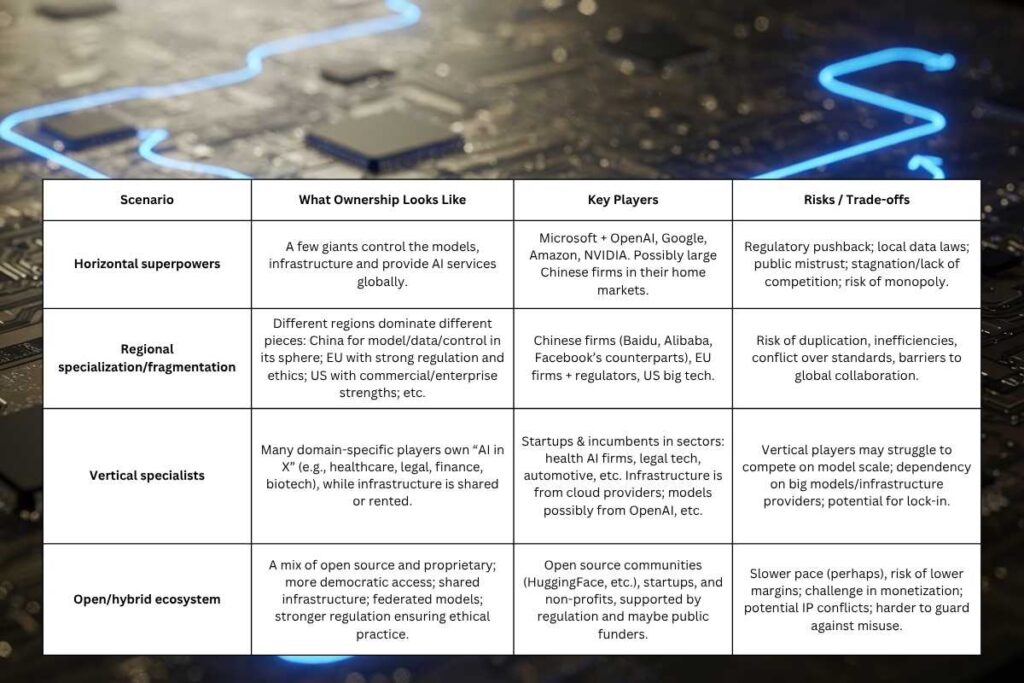

It seems unlikely that one actor will own everything. More likely, we’ll see ecosystems of layered ownership, shifting alliances, and regional variation. Here are some plausible scenarios/combinations.

| Scenario | What Ownership Looks Like | Key Players | Risks / Trade-offs |

| Horizontal superpowers | A few giants control the models, infrastructure and provide AI services globally. | Microsoft + OpenAI, Google, Amazon, NVIDIA. Possibly large Chinese firms in their home markets. | Regulatory pushback; local data laws; public mistrust; stagnation/lack of competition; risk of monopoly. |

| Regional specialization/fragmentation | Different regions dominate different pieces: China for model/data/control in its sphere; EU with strong regulation and ethics; US with commercial/enterprise strengths; etc. | Chinese firms (Baidu, Alibaba, Facebook’s counterparts), EU firms + regulators, US big tech. | Risk of duplication, inefficiencies, conflict over standards, barriers to global collaboration. |

| Vertical specialists | Many domain-specific players own “AI in X” (e.g., healthcare, legal, finance, biotech), while infrastructure is shared or rented. | Startups & incumbents in sectors: health AI firms, legal tech, automotive, etc. Infrastructure is from cloud providers; models possibly from OpenAI, etc. | Vertical players may struggle to compete on model scale; dependency on big models/infrastructure providers; potential for lock-in. |

| Open/hybrid ecosystem | A mix of open source and proprietary; more democratic access; shared infrastructure; federated models; stronger regulation ensuring ethical practice. | Open source communities (HuggingFace, etc.), startups, and non-profits, supported by regulation and maybe public funders. | Slower pace (perhaps), risk of lower margins; challenge in monetization; potential IP conflicts; harder to guard against misuse. |

What factors will influence who wins

Several trends and forces will shape which of these scenarios becomes dominant, and in which places.

- Regulation and law: Government policies around data privacy (GDPR etc.), AI safety, export controls, liability, fairness, and transparency will matter. Regions imposing stricter regulations may lose pace in model release but gain trust and stable markets. The EU’s AI Act, for example, is often seen as a testbed for global norms.

- Compute costs and hardware innovation: Innovations that reduce training costs, improved chips, energy efficiency, perhaps alternative paradigms (e.g., neuromorphic computing), or better hardware/software co-design could change who has scale. If hardware becomes cheaper or more accessible, more players can enter.

- Access to data and data governance: Raw data isn’t enough; curation, quality, labeling, privacy, and domain relevance are crucial. Companies with strong, diverse, clean datasets will have an edge. Data governance frameworks can govern who can use what data and how.

- Model accuracy, safety, and trust: Winning models won’t just be those that do well on benchmarks; trust, interpretability, safety (robustness, fairness, mitigation of misuse) will become differentiators. Buyers (both consumers and enterprises) will demand models that are safe, explainable, and aligned.

- Ecosystem effects: Once a platform has many users, developers, data sources, integrations, etc., network effects kick in. This is part of why big incumbents have power. But ecosystems can also lock people in or freeze innovation if not well managed.

- Geopolitics and sovereignty concerns: Nations are increasingly concerned about sovereignty over data, AI infrastructure, and reducing reliance on foreign providers. Export controls, localizing cloud/data centers, and national AI strategy all play into who owns what in different regions.

- Ethics, public pressure, social license: Public trust is emerging as a central resource. A company or region that repeatedly gets in trouble for Artificial Intelligence harms, bias, or misuse could see backlash and regulation that constrains its future ownership.

Risks & downsides of the gold rush

The stakes are high, but there are also serious risks if ownership concentrates unfairly or carelessly.

- Monopoly risks: If only a handful of companies own foundational layers (models, infrastructure), they can exert outsized control, pricing, access, development priorities, and AI directions.

- Loss of diversity and innovation: Startups and non-incumbents may be shut out or have to ride on incumbents’ platforms; less experimentation, fewer alternative visions.

- Privacy & ethical concerns: Large models trained on huge datasets may violate privacy; misuse is possible; biases and harms can spread widely if models are deployed broadly without oversight.

- Digital colonialism: Regions without infrastructure or data may become dependent on foreign providers; data flows may be skewed; benefits may be captured by those who already hold capital and power.

- Regulatory backlash or fragmentation: Heavy regulation may slow innovation; inconsistent regulation across countries may increase compliance costs; fragmented markets may limit scale.

- Environmental/environmental cost: Training large models is energy-intensive; infrastructure demands (cooling, power) cause environmental footprint issues. Ownership comes with responsibility.

What might “ownership” look like in 2030-2035

Projecting a decade forward, here are some plausible states of the Artificial Intelligence ownership landscape.

- Hybrid ownership models become normal: Many foundation models will likely come from large players, but fine-tuning, customization, and vertical deployment will be done by specialized firms. Some models might be open source or “open weight” in some regions; proprietary in others.

- Regulation shapes both access and business models: For example, requirements for model audits, transparency, data privacy laws preventing unfettered data access, and possibly regulations requiring model weights or inference to be locally hosted in certain jurisdictions (for data sovereignty).

- Compute democratization: Lower-cost hardware (or innovations like chiplets, alternative architectures) plus cloud credit programs may enable more players globally; edge AI will reduce dependence on centralized infrastructure in some application areas.

- Data collaborative models: Federated learning, data trusts, and data collaboratives may allow multiple players (even in regulated sectors) to pool data for model training without one party owning all data outright.

- Ethical ownership / public oversight: Entities (public or private) may be required to adhere to ethics codes; there might be more oversight, public participation, transparency in how models are built, and, importantly, how they are used.

- Regional divergences: China will likely continue pushing for homegrown AI, possibly with more control and regulatory oversight; Europe will try balancing innovation with ethics/rights; the US (and private sector) will push rapid productization and deployment; in developing countries, innovation may depend on partnerships with global players, or emergent local players.

Takeaways: Who will end up owning the Artificial Intelligence future?

Given everything, here are some reasoned predictions.

- Layered ownership is more plausible than single ownership. Different players will own different layers, hardware, models, data, and vertical applications.

- Big tech firms with deep pockets have the strongest chance to own the foundation layers (infrastructure, large models), due to capital, talent, and scale.

- Domain-specific champions will emerge in verticals: healthcare, autonomous driving, legal, education, etc. Many of these may not have a huge scale in models but will own niche or domain excellence and specialization.

- Open source/community / public interest groups will have influence, especially in creating norms, offering alternative models, and pushing for transparency, but probably won’t dominate commercial ownership unless regulatory shifts force more openness.

- Governments & regulation will own or at least share ownership in some sense, by setting rules, enabling infrastructure, and perhaps even operating national AI labs or public models. Sovereignty concerns will push many governments to develop local AI capacity rather than ceding everything to foreign firms.

- Global fragmentation: Likely, the “AI world” will be partially splintered, with different winners in different geographies depending on data access, regulation, infrastructure, talent, and cultural-legal norms.

What you should watch if you care (or want to invest)

If you’re watching this space, whether as a researcher, businessperson, policy-maker, or investor, keep an eye on:

- How major regulation evolves (EU AI Act, US bills, China’s AI policy)

- Which companies are securing data sources, data partnerships, and data privacy-compliant pipelines

- Hardware innovation and supply chain trends (e.g. new chips, AI accelerators, rare materials, energy use)

- Openness vs closedness: open source models, model licensing terms, model governance

- New platforms/frameworks that enable cross-platform compatibility (a software layer that abstracts over hardware)

- Emergence of ethical, transparent AI and guardrails for misuse (both from internal tools and external oversight)

- Regional AI strategies: which countries invest in AI sovereignty and capacity?

Conclusion

The AI gold rush is underway. It’s not simply about who builds the smartest model or the fastest chip; it’s about who controls the stack: hardware, data, software, regulation, and domain application. While giants like NVIDIA, Microsoft, Amazon, Google, and OpenAI are well positioned for much of the foundation, it’s unlikely any one player will “own it all.” Instead, we’ll see mixed ownership, shifting allegiances, regional variation, and evolving norms and laws.

Ultimately, “ownership” of the future of Artificial Intelligence will be negotiated, not only in boardrooms and data centers, but in courts, legislatures, public perception, and global standards. For those who understand the multiplicity of ownership, there may still be an enormous opportunity. For those who ignore the legal, ethical, and infrastructural layers, the gold may slip through their fingers.